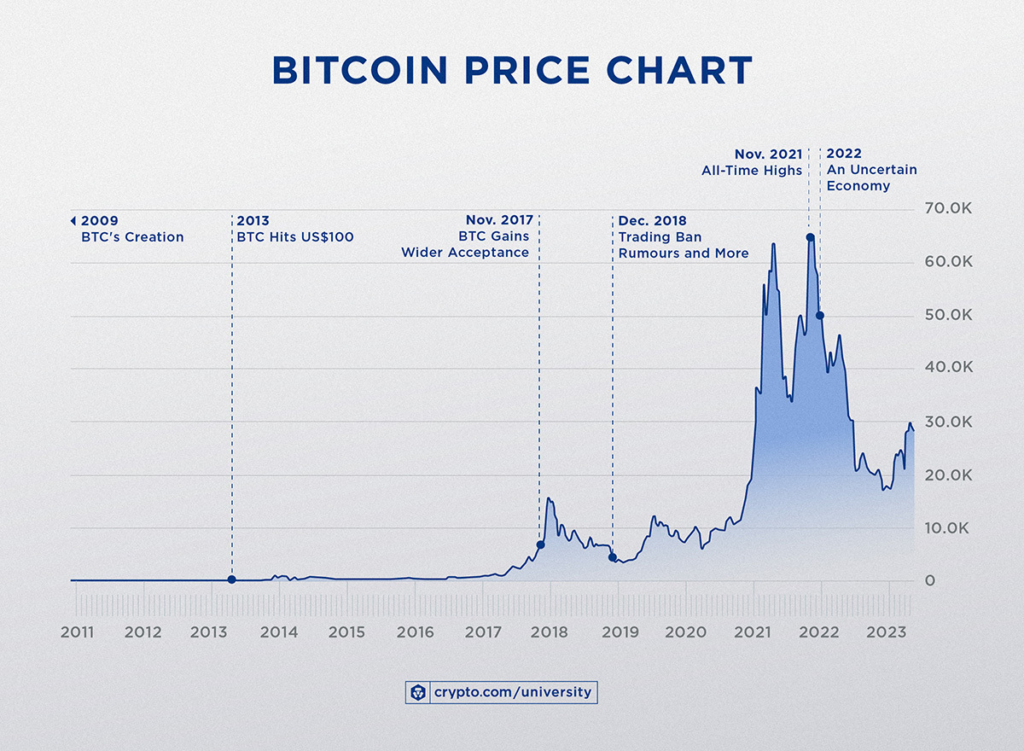

The price of Bitcoin has increased significantly in the recent trend. The price increased by 17% in the last week, demonstrating a strong positive trend. Price forecasts indicate that in the upcoming years, the price of Bitcoin is anticipated to keep rising. For instance, it is anticipated that the price will range from $54,808.86 to $68,511.08 in 2024. Likewise, the projected price range for 2025 is $82,213.30 to $95,915.51. These forecasts are supported by a number of sources, including technical indications, historical patterns, and market analysis. It’s crucial to remember that cryptocurrency markets are extremely erratic, and any choice to invest should only be taken after careful analysis and risk assessment.

There are a number of reasons behind the price increase of Bitcoin. The growing interest in Bitcoin among institutions is one of the main motivators. The fact that big businesses and financial institutions are beginning to invest in Bitcoin has helped to drive up its price. The increasing use of Bitcoin as an inflation hedge and digital store of value has also contributed to the price increase. Furthermore, the demand for Bitcoin has been impacted by macroeconomic factors including monetary policy decisions and geopolitical conflicts, which have an effect on the price trajectory of the cryptocurrency.

The process of analysing Bitcoin’s price is intricate and requires looking at a number of factors, such as market micro structure, Bitcoin-specific factors, fundamentals found in financial and economic literature, and the dynamic relationship between price and interest in the cryptocurrency. According to common monetary economic theories, studies have demonstrated that the price of Bitcoin is correlated with standard fundamental elements including money supply, trade volume, and price level. Analysis of the Bitcoin market micro structure has also provided insights into the predominance of non-fundamental price movements and speculation.

In summary, a variety of factors, including institutional interest, market demand, macroeconomic circumstances, and fundamental drivers, are reflected in the trending price of Bitcoin. Predictions of prices show that the recent price spike will continue on its upward trajectory. Due to the extreme volatility of the market, it is imperative to approach cryptocurrency investments cautiously and carry out extensive study before making any decisions.

Bitcoin’s historical data:

| Date | Open | High | Low | Close | Volume |

| 2024-02-12 | $48,296.39 | $50,255.67 | $47,774.38 | $49,925.19 | 33012277248 |

| 2024-02-11 | $47,768.97 | $48,535.94 | $47,617.41 | $48,293.92 | 19315867136 |

| 2024-02-10 | $47,153.53 | $48,146.17 | $46,905.32 | $47,771.28 | 16398681570 |

A summary of Bitcoin’s price history is given in this table, together with information on each date’s opening, closing, highest, and lowest prices as well as trading volume.

Click here: Paytm’s stock fell 10% today, down 43% over the previous three days.

What factors influence Bitcoin’s price movements?

Bitcoin price fluctuations are influenced by a myriad of factors, including market demand and supply dynamics, investor sentiment, levels of adoption and acceptance, the regulatory environment, the potential for market manipulation, technological advancements, macro-economic conditions, and speculative trading activity. Are. These factors collectively shape the market’s perception of Bitcoin’s value, causing its price to fluctuate. Positive developments such as increased adoption by mainstream institutions or favorable regulatory decisions often push prices higher, while negative news or regulatory actions can trigger a selloff and a decline in prices. Additionally, market sentiment, influenced by macroeconomic conditions and investor psychology, plays a significant role in short-term price movements, often leading to periods of increased volatility. Overall, the price of Bitcoin reflects a complex interplay of fundamental, technical, and psychological factors, making it a dynamic and volatile asset.

Is it too late to invest in Bitcoin?

Investing in Bitcoin is not about timing the market; It is about understanding its underlying technology and potential. Bitcoin operates on a decentralized network with a limited supply, which differentiates it from traditional currencies and assets. Although its price has experienced significant fluctuations, Bitcoin’s utility as a store of value and potential hedge against inflation make it an attractive long-term investment for some people. When it is “too late” to invest depends on your perspective and investment strategy. Instead of focusing on timing, consider whether Bitcoin aligns with your investment goals and risk tolerance, and if so, invest with a long-term mindset.